- implement today

- consider cost

- get a hold of a cellular mortgage director

- funds

- mortgage brokers

- strengthening property

if you were considering building the home you constantly wanted, arranging the brand new loans might possibly be easier than you understand.

where carry out we initiate ?

regarding as little as an excellent 10% deposit, you might build as opposed to to purchase a preexisting assets. strengthening a separate domestic actually susceptible to the latest rbnz financing in order to worthy of restrictions.

there are some points to consider when considering strengthening your home. if you are prepared to take on a developing endeavor, the initial step is to find your own loans in order. it guarantees you’ll be positive about wanting that prime part, otherwise speaking to regional create businesses that have a definite budget in the mind.

call us to talk from procedures involved to carry the building venture your the audience is here to assist.

- make plans

- find a paragraph

- look for a design

applying for a developing loan

away from only a good 10% put, you could generate in the place of to invest in a current assets. building a separate domestic is not subject to the mortgage so you’re able to worthy of constraints (if for example the mortgage is eligible in advance strengthening). talk to one of the group to find out if you happen to be qualified.

kiwisaver basic domestic give

if you have shared for three ages toward kiwisaver you can be eligible for a good kiwisaver basic home offer. the kiwisaver earliest family give will bring eligible very first-home buyers with a give to get on the acquisition of a preexisting/earlier domestic. the fresh new grant will be to $5,100 for individuals and up so you can $ten,100000 in which there are two or more qualified buyers.

kiwisaver earliest household grant criteria

you must have provided frequently so you’re able to kiwisaver to own at least 3 years, at the least the new minimal allowable portion of their complete money.

made $95,one hundred thousand otherwise less (just before taxation) in the last 1 year because the an only customer, or if two or more people a blended income out of $150,000 otherwise faster (prior to income tax) over the past 12 months.

provides in initial deposit that’s 5% or even more of your price. for example the new kiwisaver very first home detachment, earliest house grant and just about every other funds such as for example savings, or in initial deposit gifted because of the a relative.

get a hold of a section

the next thing is to get the best place to set the new family. you might come across an empty part that meets your criteria before making a decision into household decide to generate in it.

as an alternative, a property and residential property package could be the trusted choice where you can have input into home build but don’t keeps to consider managing that which you on your own.

while you are fortunate to locate your prime house is currently built, the acquisition of the home will be believed within the the latest build’ mortgage so you’re able to worthy of limits. definition you can also just need good ten% deposit to invest in they. the house needs to be not as much as 6 months old and you can hasn’t come prior to now occupied to meet the requirements.

look for a routine

building people gets pre-taken agreements you need to use and you can adapt to meet your requirements. keep in mind you to and make change to people preparations will likely increase the price making it good to cause for a boundary so you’re able to support such change.

knowing just what you may be immediately after, you possibly can make a customized domestic structure courtesy an architect and you may next get that bundle valued right up through a builder.

there are many different choices to finding your ideal household. the choice hinges on the kind of house you prefer, your finances as well as how much enter in you would like on household construction.

once you have made the decision, their preparations will then need to be published to your neighborhood council to get a developing concur.

the newest create starts

most stimulates need the web site to be removed as well as so much more difficult websites, retaining walls and you can postings might need to be placed positioned just before functions may start toward setting the new foundations. dependent on just what choices you have made for your house construct it usually takes from 8 weeks so you’re able to one year to do.

facts progress costs

when you find yourself strengthening, advances repayments are designed to their creator from inside the degree. it assures you might be merely purchasing the work that was done from inside the create.

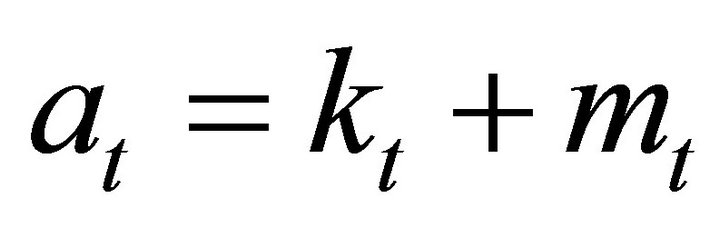

the bucks share would-be used basic, up coming while the biggest levels of the create are complete, repayments might be removed down from your own loan and you can paid down yourself to the builder.

approaching completion of one’s brand new home

you’ll end up informed of a date your builder have a tendency to hands the house or property more – and here you will get new keys to the new domestic!

for us to discharge the final percentage you’ll want to assist all of us understand when that handover time is, and supply united states to the pursuing the records: